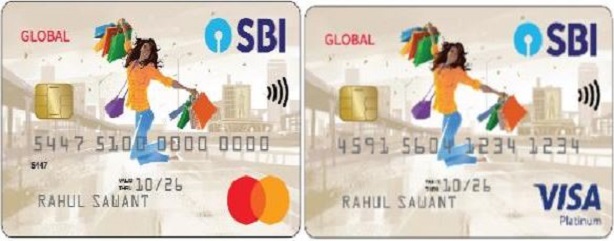

SBI Global International Debit Card – With the SBI Global International Contactless Debit Card, you can shop without using cash and earn SBI Rewardz points for your purchases. You can use “SBI Global International Debit Card” to make purchases at retail stores, pay online, and withdraw cash both in India and internationally. The EMV Chip on the SBI Global Contactless Debit Card adds an extra layer of security.

SBI Global Credit Card

SBI Global International Debit Card is always in the customer’s possession since electronic payments can be made by simply waving the contactless card in front of the PoS terminal rather than dipping or swiping it.

State Bank Debit Card Features

The SBI Global International Debit Card is a versatile card that offers a variety of features and benefits. Here are some of the key features of the card:

- International acceptance: The card is accepted at over 30 million merchants worldwide.

- Reward points: You can earn 2 SBI Rewardz points for every Rs. 200 spent on the card. These points can be redeemed for a variety of rewards, such as air tickets, hotels, and merchandise.

- Airport lounge access: You can get complimentary access to select airport lounges in India and abroad.

- Travel insurance: The card comes with travel insurance that covers a range of risks, such as accidental death, medical expenses, and baggage delay.

- 24/7 customer support: You can get 24/7 customer support in case of any problems with your card.

Here are some of the other benefits of the SBI Global International Debit Card:

- You can use the card to make online purchases.

- You can set up a recurring payment for bills and subscriptions.

- You can get a duplicate card if your card is lost or stolen.

- You can block your card if it is compromised.

The SBI Global International Debit Card is a great option for people who travel frequently or who want to earn rewards on their card spends. The card offers a variety of features and benefits that can help you save money and enjoy a more convenient travel experience.

Here are some of the key terms and conditions of the SBI Global International Debit Card:

- The annual fee for the card is Rs. 500.

- There is no joining fee for the card.

- The card has a foreign currency mark-up of 3%.

- The card has a cash withdrawal limit of Rs. 50,000 per day.

- The card has a credit limit of Rs. 2 lakh.

If you are considering applying for the SBI Global International Debit Card, I recommend that you read the terms and conditions carefully before you apply.

- For shopping at over 52 Lakh merchant outlets in India, and over 30 million worldwide.

- For booking movie tickets, bill payments, travel and other online purchases and payments over the internet.

- For withdrawing cash from SBI ATMs or other ATMs in India and worldwide

- Safe online shopping and e-commerce transactions

- The PIN will not be prompted if the NFC enabled Card is being used at NFC terminal for transaction up to ₹5000/-. Maximum such five contactless transactions without PIN are permitted per day.

SBI Global Debit Card Lounge Access List 2025

Here’s the latest list of airports where SBI Global Debit Card provides lounge access:

| City | Airport | Lounge Name |

|---|---|---|

| Delhi | IGI Airport, T3 | Encalm Lounge |

| Mumbai | CSI Airport, T2 | Loyalty Lounge |

| Bangalore | Kempegowda, Domestic | BLR Domestic Lounge |

| Hyderabad | Rajiv Gandhi Airport | Encalm Lounge |

| Chennai | Chennai International | Travel Club Lounge |

Note: Lounge availability may change. Always check the updated list before travel.

SBI Global Debit Card Lounge Access Charges After Free Limit

| Transaction Type | Charge |

|---|---|

| Beyond Free Visits | ₹25 to ₹35 (lounge verification fee) + actual lounge fee (varies by lounge) |

| Declined Access (due to ineligibility) | ₹2 (for attempted swipe) |

State Bank Debit Card Loyalty Program

State Bank Global Debit Card earns 2 SBI Rewardz point (Reward point) for every Rs. 200/- you shop, dine out, fill fuel, book travel or spend online.

- Activation Bonus : Earn 200 Bonus points on the first three purchase transactions using your State Bank Global Debit Card within a month:

- Birthday bonus: Standard points earned for the Birthday month will be doubled.

These SBI Rewardz Points earned can be accumulated and redeemed for exciting gifts. Please visit http://www.rewardz.sbi for more information or download SBI Rewardz mobile app.

Issuance and Annual Maintenance Charges

| Particulars | Charges* |

|---|---|

| Issuance Charges | Nil |

| Annual Maintenance Charges | Rs 125/- plus GST |

| Card Replacement Charges | Rs 300/- plus GST |

How To Apply for SBI Global International Debit Card?

There are two ways to apply for the SBI Global International Debit Card: online and offline.

To apply online:

- Go to the SBI website and log in to your account.

- Click on the “Debit Cards” tab.

- Click on the “Apply for a Debit Card” button.

- Select the “SBI Global International Debit Card” from the list of cards.

- Enter your personal and contact details.

- Upload the required documents.

- Submit your application.

To apply offline:

- Visit your nearest SBI branch.

- Fill out an application form.

- Submit the application form along with the required documents.

The required documents for applying for the SBI Global International Debit Card are:

- A copy of your PAN card.

- A copy of your Aadhaar card.

- A copy of your recent passport-sized photograph.

- A copy of your latest bank statement.

The processing time for the SBI Global International Debit Card is typically 7-10 working days. Once your application is approved, you will receive your card in the mail.

Here are some of the benefits of the SBI Global International Debit Card:

- You can use the card to make purchases both in India and abroad.

- You can withdraw cash from ATMs in India and abroad.

- You can earn reward points on your card spends.

- You can get access to airport lounges.

- You can get travel insurance.

The annual fee for the SBI Global International Debit Card is Rs. 500. However, there is no joining fee.

- SBI’s 24×7 helpline through Tollfree 1800 11 2211 (BSNL/MTNL), 1800 425 3800 or Toll no. 080-26599990.

- Visit Official Webpage – https://www.sbi.co.in/web/personal-banking/cards/debit-card/sbi-global-international-debit-car

- Mail at contactcentre@sbi.co.in

- Write to State Bank Contact Centre, P.O. Box No. 825, Bangalore 560 008.

Does SBI Global Debit Card Offer Lounge Access?

Yes, the SBI Global Debit Card offers complimentary airport lounge access at select domestic airports across India. Cardholders can enjoy free access to participating lounges through the RuPay Lounge Access Program.

Is lounge access available on international airports with SBI Global Debit Card?

No. Lounge access is restricted to select domestic airports in India.

Do all variants of SBI Global Debit Card offer lounge access?

No. Only RuPay SBI Global Debit Card offers lounge access, not Visa or Mastercard variants.

How to check my free lounge visit balance?

You can call SBI customer care or check through the RuPay Lounge website using your card details.