RuPay Prepaid Card – A Rupay prepaid card is a type of debit card that is issued by the National Payments Corporation of India (NPCI). Rupay prepaid cards are accepted at all merchants that accept Rupay cards.

Rupay prepaid cards offer a variety of benefits, including convenience, security, flexibility, and rewards. They are a good option for people who want a secure and convenient way to pay for goods and services.

RuPay Prepaid Card Types

- RuPay Prepaid Card

- Classic – RuPay Classic Prepaid Card

- Corporate – RuPay Corporate Prepaid Card

- Platinum – RuPay Prepaid Platinum

- RuPay Prepaid Gift Card

- RuPay Prepaid Payroll Card

- RuPay Prepaid Student Card

- RuPay Prepaid Virtual Card

Rupay Prepaid Card Benefits

Rupay prepaid cards offer a variety of benefits, including:

- Convenience: You can use your Rupay prepaid card to make payments at any merchant that accepts Rupay cards. This includes online and offline merchants.

- Security: Rupay prepaid cards are a secure way to pay for goods and services. Your card details are protected by encryption, and you can set a PIN to protect your card from unauthorized use.

- Flexibility: You can load money onto your Rupay prepaid card as needed. This gives you the flexibility to use your card for everyday purchases, travel, or emergencies.

- Rewards: Some Rupay prepaid cards offer rewards programs. This means that you can earn points or miles for every rupee you spend. These points or miles can then be redeemed for travel, merchandise, or other rewards.

Rupay Prepaid Card Offers

There are a variety of Rupay prepaid card offers available. These offers can vary depending on the issuer of the card, but some common offers include:

- Welcome bonus: Some issuers offer a welcome bonus when you open a Rupay prepaid card. This bonus can be in the form of points, miles, or cashback.

- Rewards: As mentioned earlier, some Rupay prepaid cards offer rewards programs. These programs can offer points, miles, or cashback for every rupee you spend.

- Discounts: Some issuers offer discounts on goods and services when you use your Rupay prepaid card. These discounts can be on travel, dining, or other expenses.

- Airport lounge access: Some premium Rupay prepaid cards offer airport lounge access. This means that you can use the lounges at airports when you are traveling.

How to use Rupay Prepaid Card

RuPay prepaid cards offer a convenient way to make payments and can be used for various purposes. Here’s a breakdown on how to use them:

Using your RuPay prepaid card:

- In Stores: At stores with Point-of-Sale (PoS) terminals, simply swipe your card or use contactless payment if your card has that feature. You’ll likely need to enter your PIN to complete the transaction.

- At ATMs: You can withdraw cash from ATMs that display the RuPay logo. Insert your card, enter your PIN, and select the withdrawal amount.

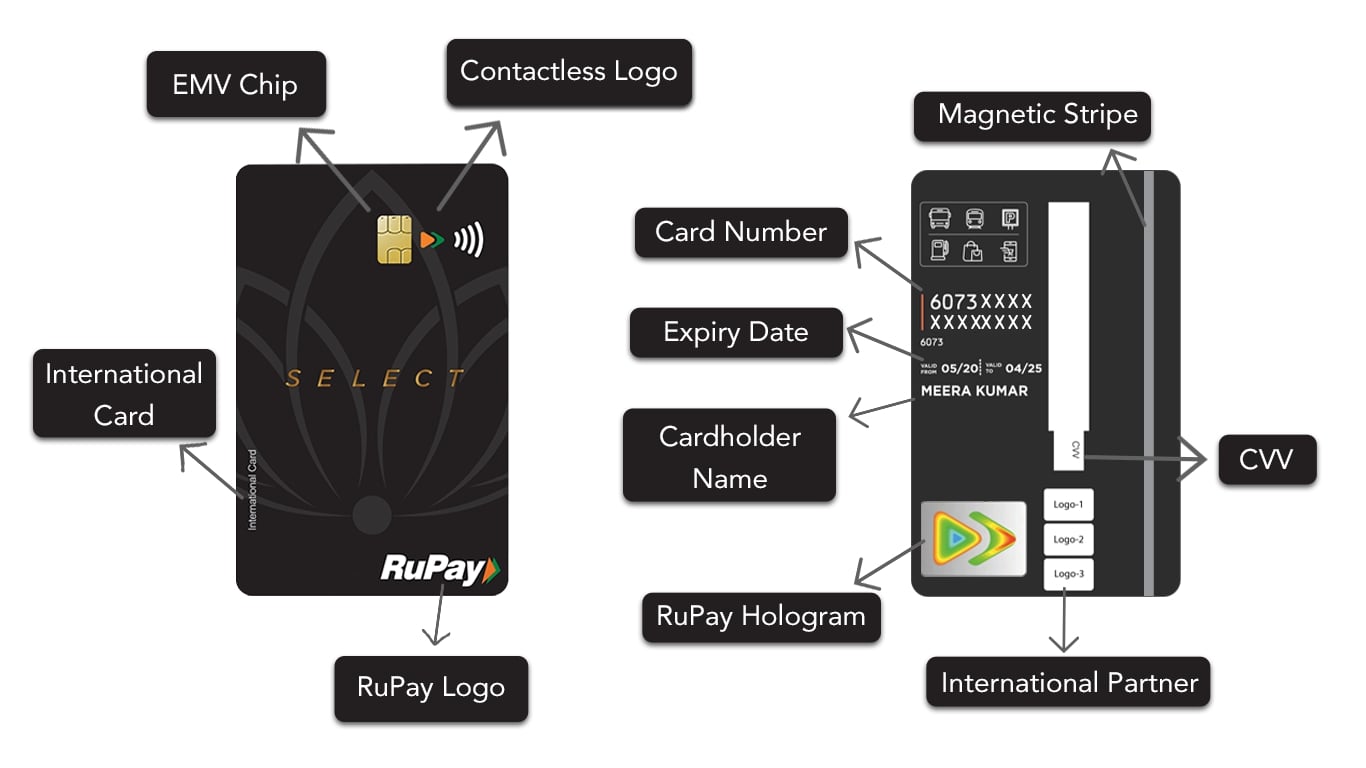

- Online Transactions: Some RuPay cards need to be activated for online use. Check with your bank for activation instructions. For online purchases, enter the card details (card number, expiry date, CVV) on the payment page during checkout.

Adding funds to your card (reloading):

- Net Banking: Many banks allow you to reload your RuPay card through their net banking portal.

- Mobile Banking: Likewise, some banks offer mobile banking options for reloading your card.

- Cash Deposit: You might be able to reload your card by depositing cash at a bank branch (check with your bank for their policy).

How to Get Rupay Prepaid Card?

RuPay prepaid cards are issued by various banks in India. The process to obtain one can differ slightly depending on the bank you choose and the type of card you’re interested in. Here’s a general guideline:

1. Choose a Bank:

- Explore RuPay’s website (https://www.rupay.co.in/our-cards/rupay-prepaid) to see the range of prepaid cards offered. They have cards for various purposes, including travel, gifting, and managing expenses.

- Consider banks in your area or ones you already bank with. Many banks offer RuPay prepaid cards alongside other services.

2. Check Eligibility:

- Eligibility requirements can vary. Some cards may require minimal documentation, while others might have stricter criteria.

- Generally, you’ll need to be a resident of India with valid ID proof and address proof.

3. Apply for the Card:

- Banks might offer multiple application channels – online through their website, mobile banking app, or by visiting a branch in person.

- During application, you’ll likely provide your KYC (Know Your Customer) documents and choose a PIN for your card.

4. Receive Your Card:

- Depending on the bank and card type, you might receive an instant virtual card or a physical card delivered to your address.