Debit cards, also referred to as plastic cash, are issued by banks and are used to fund purchases in daily life. With a debit card, you can use ATMs to access your savings account electronically at any bank. Your bank account can be withdrawn from and deposited into using the card. Many people find a debit card to be convenient.

A debit card is a type of payment card that can be used in place of cash to make purchases. Debit cards are also sometimes referred to as check cards, bank cards, or plastic cards. It is comparable to a credit card, but in contrast to a credit card, the funds for the purchase have to be present in the cardholder’s bank account at the time the purchase is made. The funds are then transferred immediately and directly from the cardholder’s account to the account of the merchant in order to pay for the purchase.

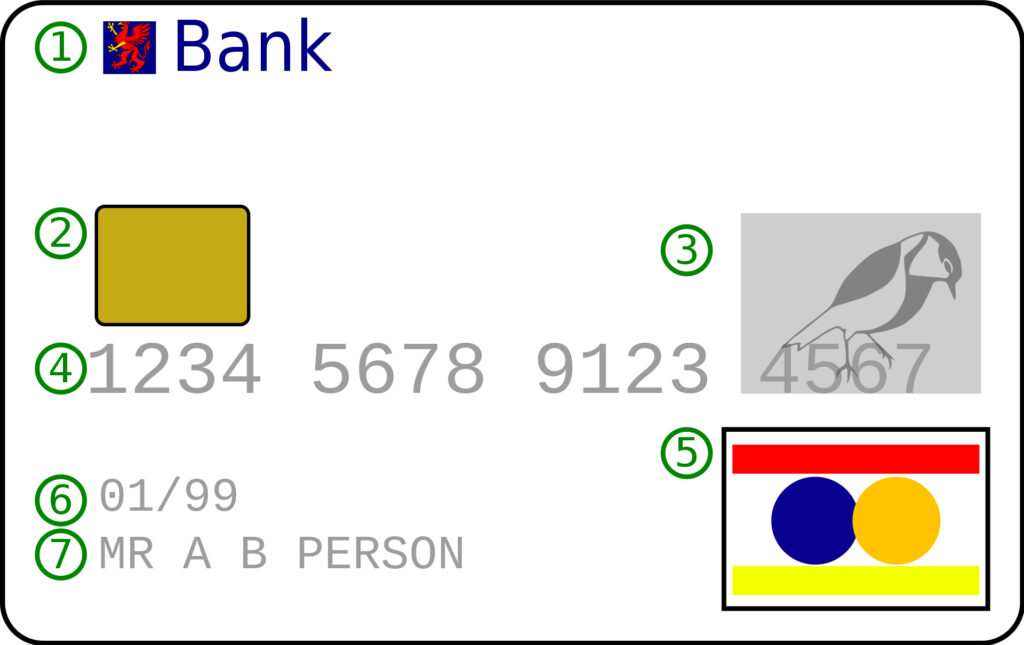

An example of the front of a typical debit card:

- Issuing bank logo

- EMV chip (optional and may depend on the issuing institution or bank)

- Hologram (in some cards it’s located at the back especially in most MasterCard)

- Card number (PAN) (may vary in length but mostly 16-digits with unique last 4 digits. However in cases such as Discover, Diner’s Club, UnionPay & American Express it has a unique 15-digit card number)

- Card brand logo

- Expiration date

- Cardholder’s name

Some debit cards (prepaid cards) have a stored value that can be used to make a payment, but the majority of debit cards send a request to the cardholder’s bank to withdraw money from the cardholder’s specified bank account. In some cases, there is no physical card present and the payment card number is only assigned for use online. Known as a virtual card, this is.

Debit cards are now so widely used that in many nations they have either completely replaced or outperformed cheques in terms of volume. In some cases, debit cards have also largely replaced cash transactions.

Debit card development, in contrast to credit card and charge card development, has typically been country-specific, leading to a variety of different systems worldwide that were frequently incompatible. Since the middle of the 2000s, a number of initiatives have made it possible to use debit cards issued in one country in another, as well as to make purchases over the phone and the internet.

Debit cards typically also permit immediate cash withdrawals, serving as an ATM card in this way. Additionally, retailers might let customers use their cashback privileges to withdraw cash in conjunction with their purchases. The amount of cash that may be withdrawn typically has daily caps. Debit cards are typically made of plastic, but occasionally they are also made of metal or wood.

Types of Debit Cards in India

Visa Debit Cards are issued through a partnership between the bank and VISA payment services, which provide the Verified by Visa (VbV) platform for online transactions. Read More about Visa Debit Cards.

Visa Electron Debit Cards are very similar to Visa debit cards, with the exception that these cards do not offer overdraft protection. Read more about Visa Electron Debit Cards.

Near Field Communication (NFC)-enabled contactless debit cards enable customers to make payments with a tap or wave near point-of-sale terminals, thereby securing electronic payments. Read more about Contactless Debit Cards.

The NPCI has introduced RuPay Debit Cards as a domestic card scheme. These cards facilitate online purchases and transactions on the Discover network as well as ATM transactions on the National Financial Switch network. Read more about RuPay Debit Cards.

Merchant Discount Rate on Debit Cards

The Merchant Discount Rate (MDR) changed on January 1, 2018, because of a change made by the Reserve Bank of India. For those who don’t know, the Merchant Discount Rate is how much the vendor or merchant has to pay Visa for each transaction. Based on the changes made by RBI, the MDR will now be based on the merchant’s or company’s turnover instead of the slab-based structure that is in place now.

The MDR applies to transactions at POS terminals, online transactions, and transactions using QR codes. As was already said, merchants, vendors, and companies will be charged based on how much money they make in a year. There are two types of merchants: those who make up to Rs.20 lakh and those who make more than Rs.20 lakh.

For merchants whose sales in the previous financial year were up to Rs.20 lakh, transactions made online or at POS terminals will be limited to 0.40% or Rs.200. For transactions based on QR codes, the MDR will not be more than 0.30 percent of the transaction, or Rs.200.

For merchants with a turnover (in the previous financial year) of more than Rs.20 lakh, the MDR will be limited to 0.90% or Rs.1,000 for transactions made at POS terminals or online. For transactions based on QR codes, the MDR will be limited to 0.80%, or Rs.1,000 per transaction.

Debit Cards from Top Banks

- SBI Debit Card

- IndusInd Debit Card

- Kotak Mahindra Bank Debit Card

- YES BANK Debit Card

Debit Cards By Bank

- Abhyudaya Bank RuPay Debit Card

- Axis Debit Card

- Allahabad Bank Debit Card

- Andhra Bank Debit Card

- Bank of Baroda Debit Card

- Bank of India Debit Card

- Barclays Bank Debit Card

- Canara Bank Debit Card

- Corporation Bank Debit Card

- Central Bank of India Debit Card

- Citibank Debit Card

- DCB Debit Card

- Dena Bank Debit Card

- Deutsche Bank Debit Card

- Federal Bank Debit Card

- HDFC Debit Card

- HSBC Debit Card

- Indian Overseas Bank Debit Card

- IDBI Debit Card

- Indian Bank Debit Card

- Karnataka Bank Debit Card

- Karur Vyasya Bank Debit Card

- Oriental Debit Card

- Punjab National Bank Debit Card

- Punjab And Sind Bank Debit Card

- RBL Debit Card

- RBS Bank Debit Card

- Saraswat Bank Debit Card

- South Indian Bank Debit Card

- SBI Debit Card

- Standard Chartered Debit Card

- Syndicate Bank Debit Card

- UCO Bank Debit Card

- United Bank of India Debit Card

- Union Bank Debit Card

- Vijaya Bank Debit Card

Types of Debit Cards

- Contactless Debit Cards

- Maestro Debit Cards

- MasterCard Debit Cards

- RuPay Debit Cards

- VISA Debit Cards

- VISA Electron Debit Cards